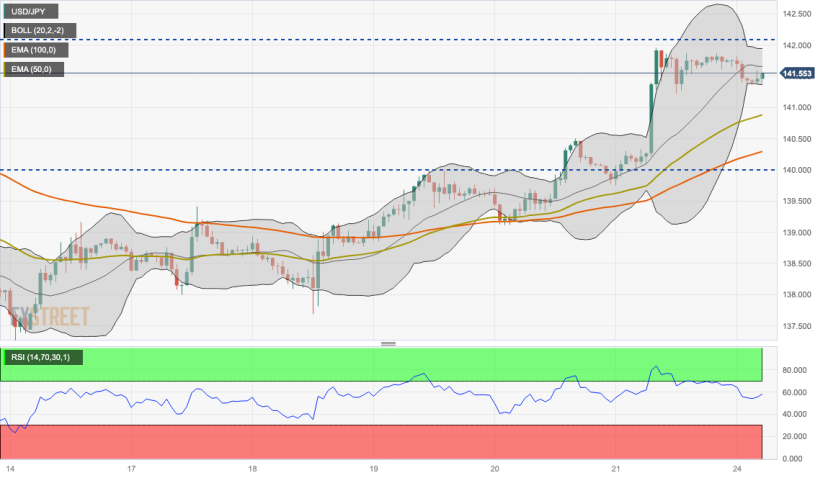

- USD/JPY consolidates its recent gains above the 141.50 mark heading into the European session.

- The critical resistance zone is located at 141.95–142.00; 140.85 acts as an immediate support level.

- The Relative Strength Index (RSI) stands above 50, indicating bullish territory.

The USD/JPY pair consolidates its recent gains heading into the European session on Monday. Market players prefer to wait to be sidelined ahead of the Federal Reserve's (Fed) and Bank of Japan's (BoJ) monetary policy decisions. The major pair currently trades near 141.50, down 0.22% on the day.

USD/JPY has edged higher after Reuters reported that the BoJ will likely maintain the easy-money and yield control policies in the July meeting. On the other hand, the Fed will announce its monetary policy decision on Wednesday. The market expected a 25 basis point (bps) rate hike. This, in turn, led to the weakening of the Japanese Yen against its major rivals due to monetary policy divergences between the BoJ and Fed.

According to the one-hour chart, Any meaningful follow-through buying beyond 141.65 could pave the way to the next hurdle at the 141.95–142.00 zone, highlighting a psychological round mark and the upper boundary of the Bollinger Band. The additional upside filter to watch is 142.10 (Low of July 7), followed by the 143.00 area (a psychological round mark, High of July 10). The next barrier to watch is at 143.55 (High of July 10).

On the flip side, a break below 141.35 would expose to 140.85, portraying the 50-hour Exponential Moving Average (EMA) en route to 140.30 (100-hour EMA) and finally 140.00, a confluence of a psychological round figure and a high of July 19.

It’s worth noting that the Relative Strength Index (RSI) stands above 50, indicating further upside cannot be ruled out.