- The EUR/USD hit a fresh 20-year low at 0.9700 during the North American session.

- Fed’s aggressive tightening cycle and UK’s plan to bolster the economy spurred a risk-off impulse.

- EUR/USD Price Analysis: A decisive break below 0.9700 could send the pair tumbling towards September 2002 lows around 0.9601.

The EUR/USD nosedives below the 0.9800 figure, extending its losses towards the 0.9700 figure, below its opening price by 1.32%, triggered by traders’ worries that Fed’s aggression would tip the US economy into a recession, while the UK announced a plan aimed to lift stimulate the economy.

The EUR/USD is falling off the cliff after reaching a daily high of 0.9851, but the aforementioned factors shifted sentiment sour. Therefore, the shared currency dropped to a fresh 20-year low at around 0.9700. When writing, the EUR/USD is trading around 0.9720.

EUR/USD sinks on upbeat US economic data and risk-off impulse

On Wednesday, the US Fed lifted the Federal funds rate (FFR) by 75 bps and emphasized that it will “keep at it” to tame inflation. In the same meeting, Fed officials estimated that the FFR would likely end at 4.4%, meaning that 125 bps of rate hikes are pending.

Data-wise, the US S&P Global PMIs for September flashed that the US economy is in contractionary territory but showed some improvement. The Manufacturing PMI expanded by 51.8, above forecasts, while the Services and Composite indices improved but fell short of expansionary territory.

Earlier, S&P Global reported PMIs for the Euro area, which persisted in recessionary territory, undermined by Germany’s PMIs. The Eurozone Manufacturing and Services PMI were lower than the previous reading; consequently, the Composite Index edged lower to 48.2, below the last reading, below estimations.

Nevertheless, business activity grew alongside the composite PMI in France, but manufacturing remained depressed. Earlier the ECB member Kazaks said that he would back a 75 bps rate hike, though he would not rule out a 50 bps increase in the October meeting.

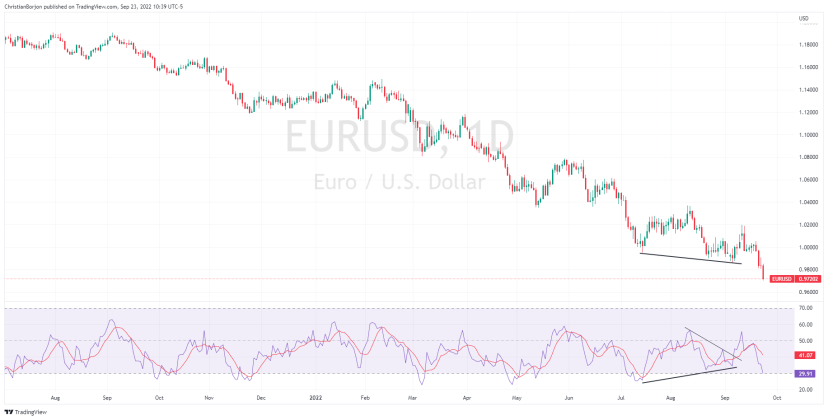

EUR/USD Price Analysis: Technical outlook

The EUR/USD extended its losses towards the 0.9700 psychological level, set to finish the week with losses of almost 3%. Even though the euro’s fall has been fast, the Relative Strength Index (RSI) is in bearish territory but not at oversold conditions, opening the door for further losses. A break below 0.9700 could pave the way towards September 2002 lows at around 0.9601.